The Best CRM for Mortgage Brokers: Powering Your Path to More Closed Loans in 2025

The mortgage industry is a whirlwind of activity: managing leads from diverse sources, nurturing relationships with borrowers and real estate agents, navigating complex loan applications, and ensuring timely communication every step of the way. For mortgage brokers and loan officers striving for efficiency and growth, a generic CRM simply won’t suffice. You need the best CRM for mortgage brokers – a specialized platform designed to handle the unique demands of loan origination and client management in the financial services sector.

A top-tier mortgage CRM can transform your daily operations, from initial lead capture to post-closing follow-up, helping you close more loans and build lasting relationships. This guide will explore the critical features that define the best CRMs for mortgage professionals and discuss how cutting-edge AI communication tools, like those offered by Glue Sky, can significantly enhance your outreach, engagement, and overall productivity.

Why Mortgage Brokers Need a Specialized CRM Solution

The journey of a mortgage application is intricate, involving multiple stakeholders, stringent compliance requirements, and a high need for personalized communication. A generic CRM often falls short because it doesn’t understand:

- The Loan Origination Lifecycle: From pre-qualification and application to underwriting, approval, and closing, each stage has specific data and communication needs.

- Key Data Points: Mortgage CRMs need fields for loan types (FHA, VA, Conventional), credit scores, income verification, property details, interest rates, and more.

- Referral Partner Management: Nurturing relationships with real estate agents, financial planners, and builders is crucial for a steady flow of leads.

- Compliance and Documentation: The mortgage industry is heavily regulated. A good CRM can help manage communication trails and document collection reminders.

- Long-Term Client Nurturing: Opportunities for refinances or future home purchases mean long-term relationship management is key.

A dedicated loan officer CRM is built with these nuances in mind, providing tools to streamline processes and improve client and partner interactions. For context, many general CRM tools have broader meanings but lack this specialization.

The best CRM for mortgage brokers streamlines the complex loan origination process.

Essential Features of the Best CRM for Mortgage Brokers

When searching for the ideal CRM for mortgage lenders or brokers, prioritize these critical features:

1. Robust Lead Management Tailored for Mortgages

- Lead Capture from Multiple Sources: Integration with website forms, online lead providers (e.g., Zillow Mortgages, LendingTree), real estate agent referrals, and manual entry.

- Automated Lead Assignment: For teams, rules to distribute leads to loan officers based on criteria like loan type, location, or round-robin.

- Lead Qualification & Scoring: Tools to categorize leads (e.g., “Hot,” “Warm,” “Cold,” “Pre-qualified”) and score them based on their potential.

- Duplicate Management: Prevent multiple entries for the same borrower.

2. Comprehensive Contact Management

- Detailed Borrower Profiles: Store all relevant information, including financial details (with security in mind), communication history, loan preferences, and key dates.

- Referral Partner Tracking: Manage relationships with real estate agents, builders, and financial planners, including tracking referrals sent and received.

3. Loan Pipeline and Application Tracking

- Customizable Loan Stages: Visualize the progress of each loan application through stages like “New Lead,” “Pre-Qualified,” “Application Submitted,” “Processing,” “Underwriting,” “Approved,” “Clear to Close,” “Funded.”

- Automated Status Updates: Tools to automatically notify borrowers and real estate agents as a loan moves through key milestones.

4. Powerful Communication Tools

- Email Integration & Templates: Sync emails, use pre-built templates for common mortgage communications (e.g., document requests, status updates, congratulations on closing).

- SMS/Text Messaging: For quick updates, reminders, and engaging leads. A texting CRM component is highly effective.

- Call Logging & Dialer Integration (Optional): Track phone calls and potentially integrate with dialer systems for outbound campaigns.

5. Marketing Automation for Nurturing

- Drip Campaigns: Automated email and SMS sequences for new leads, long-term prospects (e.g., those not ready to buy yet), and past clients (e.g., refinance opportunities, annual mortgage reviews).

- Personalized Content Delivery: Send relevant market updates or educational content to different segments of your database.

6. Task and Calendar Management

- Automated Reminders: For follow-ups, document deadlines, rate lock expirations, and closing dates.

- Team Task Assignment: Assign tasks to processors, underwriters, or other team members.

7. Document Management (or Integration)

- Secure Document Checklists & Storage: While a full Loan Origination System (LOS) often handles heavy document management, the CRM should at least facilitate document collection reminders or integrate with document storage solutions.

8. LOS Integration (Loan Origination Software)

This is arguably one of the most critical features. The best CRM for mortgage brokers must seamlessly integrate with your LOS.

- Two-Way Data Sync: Ensure data entered in the CRM (e.g., contact info) flows to the LOS, and loan status updates from the LOS flow back to the CRM to trigger automated communications.

- Reduced Double Data Entry: Saves time and minimizes errors.

9. Reporting and Analytics

- Loan Funnel Reports: Track conversion rates at each stage of the loan process.

- Referral Source Tracking: Identify your most valuable referral partners.

- Loan Officer Performance (for Teams): Monitor individual MLO productivity.

- Marketing Campaign Effectiveness: Analyze the ROI of different outreach efforts.

10. Compliance Support

- Audit Trails: Maintain records of communications and actions for compliance purposes.

- Secure Data Handling: Ensure data privacy and security in line with industry regulations. Your CRM database must be secure.

The AI Advantage: How Glue Sky Can Supercharge Your Mortgage CRM

While a specialized mortgage CRM handles the core loan processing and data management, AI-powered communication platforms like Glue Sky can significantly enhance the “front-end” of your business – lead engagement, initial qualification, and appointment setting.

Consider how Glue Sky’s AI tools can complement your existing mortgage CRM/LOS:

- Instant AI-Powered Lead Response:

- When new online leads arrive (e.g., from your website or third-party lead providers), Glue Sky’s AI can immediately engage them via SMS or even an AI call. This rapid response is crucial in the competitive mortgage market. Our AI cold caller can be configured for these initial touches.

- The AI can ask initial qualifying questions (e.g., “Are you looking to purchase or refinance?”, “What’s your estimated timeframe?”) before a loan officer even sees the lead.

- Automated Appointment Setting:

- Based on the initial AI conversation, if a lead shows interest and meets basic criteria, the AI can schedule a consultation call directly on a loan officer’s calendar.

- Nurturing “Not Yet Ready” Leads:

- For leads who aren’t ready to apply immediately, Glue Sky’s AI can manage automated, long-term nurture sequences using personalized emails and SMS messages, keeping your services top-of-mind.

- Realtor Partner Outreach (Strategic Use):

- AI could be used for initial outreach to potential new real estate agent partners, introducing your mortgage services and value proposition, and scheduling an introductory call.

- Past Client Engagement for Refinance Opportunities:

- AI can periodically send personalized check-ins or alerts to past clients about potential refinancing opportunities when market conditions are favorable, prompting them to connect with a loan officer.

By integrating Glue Sky’s AI outreach capabilities, mortgage brokers can ensure no lead is missed, speed-to-lead is optimized, and loan officers spend more of their time talking to genuinely interested and pre-qualified borrowers. This is how AI tools for real estate can also greatly benefit mortgage professionals.

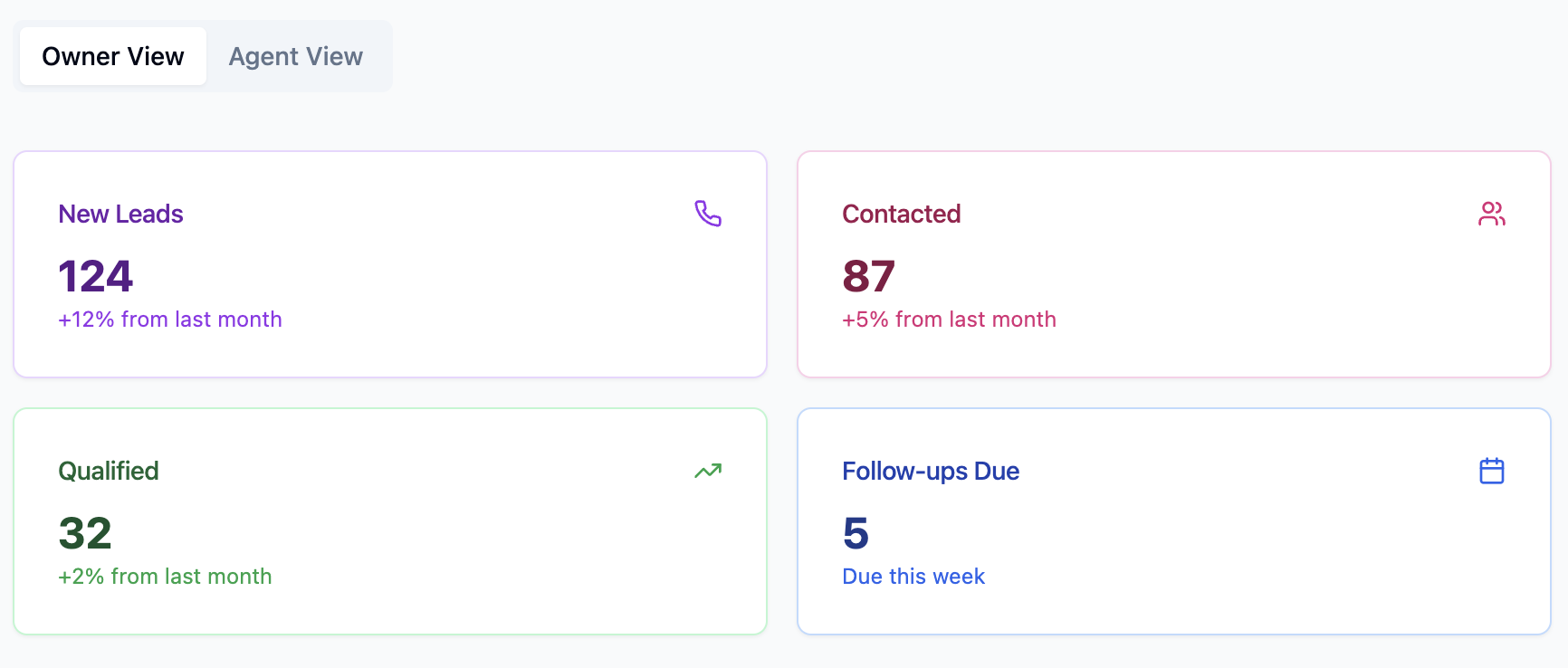

Glue Sky’s AI-powered portal can manage initial lead engagement for mortgage brokers, feeding qualified prospects into their main CRM/LOS.

Benefits of Investing in the Best CRM for Mortgage Brokers

A top-tier mortgage CRM, especially when augmented with AI communication tools, delivers substantial benefits:

- Increased Loan Volume: More efficient lead management and follow-up lead to more applications and closed loans.

- Enhanced Productivity: Automation of routine tasks frees up loan officers to focus on high-value activities.

- Improved Borrower Experience: Timely communication and transparent updates build trust and satisfaction.

- Stronger Realtor Relationships: Consistent updates and co-marketing opportunities strengthen referral partnerships.

- Better Compliance: Organized record-keeping and audit trails help meet regulatory requirements.

- Reduced Operational Costs: Efficiency gains can lead to lower costs per loan originated.

- Scalable Growth: A robust system allows you to handle increasing loan volume without a proportional increase in staff.

Choosing Your Best CRM for Mortgage Brokering

When selecting a CRM, consider:

- LOS Integration: This is paramount. Ensure seamless, ideally two-way, integration.

- Mortgage-Specific Features: Does it genuinely understand and cater to the loan origination process?

- User-Friendliness: Will your loan officers and support staff find it easy to use?

- Automation Capabilities: Look for robust workflow automation for communication and tasks.

- Scalability and Pricing: Can it grow with your business, and does the CRM cost per month offer good value?

- AI Enhancement Potential: How can AI communication tools like Glue Sky complement the CRM to boost lead engagement and qualification?

- Vendor Support and Reputation: Choose a reliable vendor with good industry knowledge.

Conclusion: Secure Your Future with the Best Mortgage Broker CRM

The best CRM for mortgage brokers is more than just software; it’s a strategic asset that underpins your entire operation. It provides the tools to efficiently manage leads, streamline the loan application process, nurture vital relationships with borrowers and referral partners, and maintain compliance in a complex regulatory environment.

By choosing a CRM with deep mortgage-specific functionalities and robust LOS integration, you lay a strong foundation. And by then leveraging the power of AI communication tools like Glue Sky for intelligent lead outreach, qualification, and nurturing, you can significantly amplify your team’s effectiveness, ensuring that loan officers spend their time on the most promising opportunities. This powerful combination is the key to thriving in the competitive mortgage landscape of 2025 and beyond.

Interested in learning how AI-powered outreach can revolutionize your mortgage lead engagement and qualification? Discover Glue Sky’s intelligent automation platform and see how it can help you close more loans!